… which you’re welcome to take or leave.

I thought I’d add this chapter to my travel blog mainly because I’m often asked how I manage to fund my trips and have the time to do what I love at this stage of my life.

I don’t win the lottery, wasn’t born into money, but I did make a conscious decision to save heavily for my own future a long time ago. It mainly comes down to having a plan with pensions at the very heart of it. I stuck with that plan steadily throughout my career, accelerating my contributions in the final years, when I was able to afford it more

Don’t work till you drop

I’ve never subscribed to the idea of working until I keel over. From a young age, I remember hearing stories of people who died just a few years after retiring. That stuck with me.

Even in my early twenties, when a pensions adviser asked me what age I wanted to retire, I didn’t hesitate, “Between 50 and 55.” That idea never left me.

In the final stretch of my working life, I ramped things up. At times, I was putting 30%, even over 50%, of my gross salary into my pension (for a couple of crazy months it was even 80% at one point). I took time to learn about UK pension and tax rules in every detail, and exploited those rules to the max. However, it meant tightening the belt at times, but I figured short-term pain was worth the long-term gain.

It hasn’t all been plain sailing. Two divorces took big bites out of my pension, half went with the first, a quarter with the second. But I don’t begrudge it. That’s the deal when you get married, and if anything, those experiences forced me to refocus and rebuild. Oddly enough, they helped.

Even when life and work were going well, I stayed grounded. Things can change quickly.

… If anyone reading this thinks I’ve been handed things on a plate you couldn’t be further from the truth. I’m from a working class background, had a pretty standard childhood, grew up on a council estate and had no inheritance hand-outs or gifted trust funds. I didn’t go to University and struggled at school (link to open apology). I always vote to the left of centre (towards politicians with a social conscience) and will remain a Trade Union member until the day I die. Oh and my nan grew up as a child working in a squalid victorian era workhouse (link to my nan).

I’ve just been a tad lucky I guess, and stumbled into pensions without too much planning, so just want to share a few tips on how to retire early – if I can do it anyone can…

Put things into perspective

Sorry for the philosophical slant of this next bit, but it kind of emphasises that main driver for me wasn’t money or simply building wealth just for the sake of it, it was more about being happy, content and making the very most out of the limited time we have on this planet.

On a full moon and when the sky is clear, I stop what I’m doing, pause and look up.

Every time I do so it puts me, and my place in this world into perspective. A tiny spec of life, standing on a ball of rock and molten lava, floating in a universe, amongst countless billions of stars and other planets. The wars we are fighting, and the reasons for doing so all seem rather pointless and irrelevant when viewing things on a cosmic scale.

I am a classic over-thinker, over analysing minutiae and worrying about trivia – always have been, but thoughts like this help me recalibrate.

So why am I talking about the moon? Well, at the time of writing this, I am 59 years of age and if I manage to live the ‘average’ lifespan of a man (81 in the UK), between now and the day I die, I will only have the opportunity to see the full moon in all its glory around 140 more times. That calculation is based on the full moon cycle over the next 22 years, minus cloud cover (data from various meteorological websites).

So I stop and look up – every time!

One day, I won’t have the energy or ability to climb mountains or go on long cycling trips, and I may no longer want to “rough it” in hostels. This drove my decision to retire early and seize each opportunity now, whilst I still can.

Some advice – based on my journey

To anyone reading this, especially those still in work, my advice would be:

- Start a contributory pension plan as early as you can – don’t procrastinate or delay! Compound growth has an amazing impact on long term investments, especially pensions. So the earlier you invest, the better!

- Contribute more than the minimum: ALWAYS invest way more than the minimum amount that your employer automatically sets. Double it, or go higher if allowed. Pensions contributions come off gross salary so aren’t subject to tax and NI. The government also hands you a top-up contribution, and depending on your tax bracket this could result in a 20% (or 40%) increase. Think about it, that’s insane, where else would you get that immediate level of guaranteed increase on top of your initial investment? …and from the government!

- Set a target: Understand the size of the pension pot you are aiming to save and use every ounce of your personal allowance to get there; that cash for a new car or push-the-boat-out holiday might just be better off going into your pension. The earlier deposits can be made, the more you will benefit from compound growth, which over the long term will make a huge impact.

- Stay on track: Even if life derails you, keep your end goal in mind.

- Know when enough is enough: Don’t trade life experiences for a bigger pension once you’ve reached your target. It’s daunting I know, but if you’ve done the maths and are able to go with the ebb and flow of the markets over the longer term – have faith in the numbers. Retire early and do the stuff your mind or body won’t allow you to do in later years.

- Seek good pension advice: you wouldn’t buy a car without some really good due diligence, so make sure you shop around.

I could go on, but you get the drift.

The big question.

Staying at work may have provided more financial security and allowed me to grow my pension pot further, but it would have meant sacrificing life experiences. So in 2021, and at the age of 56 I did the maths and decided I could afford to make my first move towards retirement.

The main stumbling block for me, like it is for so many others, was understanding how much I need to spend during the remainder of my lifetime – now that’s a BIG question!

So I calculated my monthly expenditure for both essentials and the lifestyle I wanted – obviously the latter was influenced by what I could afford (and so was/is directly linked to my pension savings and investments). I had to consider a wide range of stuff including inflation, tax, mortgage payments, bills, other investments, the impact of state pension (when that kicks in), along with my pension portfolio performance and my own risk appetite.

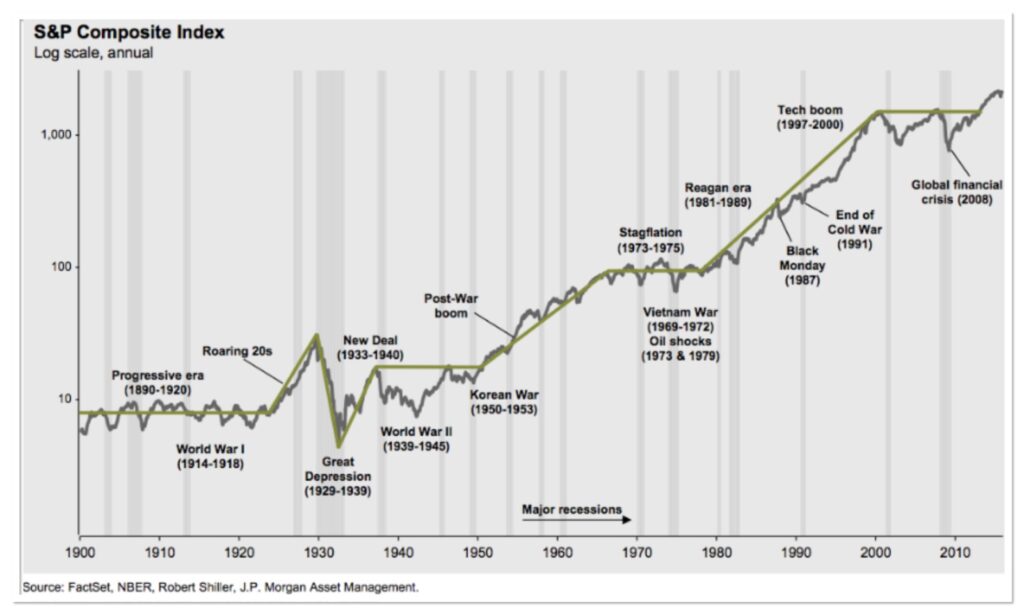

The beauty of modern drawdown pensions is that they are incredibly flexible. My personal preference is to drawdown a pension in 12 equal monthly instalments, mimicking a salary. This approach limits the speed at which the pot is reduced and allows for it’s continued investment and growth. The upside, is that over the long term (taking history as a yardstick), pension plans perform very well and grow higher than most other forms of investment vehicles. The downside is that there will be years when they don’t – the trick here is not to panic.

Don’t worry too much about what the markets are doing – especially over the short term. There will be peaks and more than the occasional trough. There has been a ton of research conducted on this topic and lots of data gathered from the past, but no-one will ever be able to give you a guarantee of what the future holds, especially a financial adviser. Global events like the ones shown below will take things off track, along with things more recently like COVID and people like Trump… All you can do is go with the flow, and combine it with your own personal appetite for risk – something a financial adviser will take you through…

The other thing seriously worth considering, is having a separate savings plan (like a cash ISA) containing a few months of salary, so if and when there is a market downturn, you can draw on your savings, rather than continue to deplete your pension pot when the unit price of shares has been hit.

Oh and don’t forget to be simply “happy with what you’ve got” and build your life around that. Don’t be bitter about decisions you’ve made in the past, they can’t be undone.

Consider an ‘off-ramp’

After I stepped away from my main career, I considered (briefly) moving into some sort of consulting job, or going part time, but that would have tied me down and restricted my flexibility, something I didn’t want. So I retrained and got myself a HGV license. I have always loved driving and was excited to experience life on the road.

On balance getting my HGV licence and working in the gig economy was absolutely the right thing to do. It gave me some confidence, allowing me to test the water and check that I’d done the right thing.

So for a few years I worked part-time, driving trucks, somewhere between eight and ten days a month. This allowed me to keep afloat, fund specific expenses (trips), and defer the formal “pension drawdown” initiation date (allowing for a few years more growth). It also felt good to have a HGV licence in my back pocket to help manage any gap in my pension for those years when the markets under-perform.

Working on a zero hours contract suited me perfectly, allowing me to control when and how often I worked. This flexibility provided peace of mind without the stress and commitment of a full-time job or consultancy.

Now I am not a huge fan of the gig economy generally, as I think many employers take the piss and expect their workers to commit to a flexible contract on the employers terms only and get the hump when workers request flexibility in return. But for me, it was ideal, as I was in a position where “I” could dictate the days, hours and type of work I wanted to do, and stick to my guns! This is something that most gig economy workers can’t afford to do on account of finding themselves sidelined or losing out on shift opportunities and money. So, even though I personally benefitted from it, I think this new form of employment contract is a retrograde step, especially when combined with the lowering of employment protection for workers that’s happened in recent years – but that’s another story.

So here I am…

If I could start over, I would’ve contributed even more towards my pension from the outset, even knowing that my two divorces significantly cut into those investments. For me, my pension has been the single most valuable financial tool I’ve had and I get frustrated when others around me don’t appear to take advantage of what’s on offer.

In my view, pension and retirement planning deserves more attention in school, the workplace, or from the government. My own route to pension planning initially came about by chance. I owe much of it to my father, who, by luck and some foresight, managed an early retirement himself. He started work at the age of fifteen on the London docks, transferred his pension to his next job as a municipal worker, and then finally into the fire service. It worked out for him in the public sector, as it has done for me in the private sector but it’s a journey that could be made much clearer for all. I fear too many miss the opportunity simply because they are not aware.

So I hope this post inspires someone to pick up even one or two of the lessons I learned on this journey and if that’s the case, I’ll be happy.

Anyway, if I’m still around and traveling in twenty or more years, I’ll update you on how it all worked out.

Fingers crossed, and happy travels!

Hints and Tips

Seeing as most of my blogs have links to hostels, hotels, airlines and other tips for travel, I’ll leave the details of my financial chap below. I found him through an Internet search about four or five years ago. I selected him over others, from a shortlist I worked up based on a set of criteria that was important to me. Like I say on my homepage, I don’t get any kick backs from any of the links I provide. I do this blog purely for fun and to share experiences. So I’ll share my chaps details in the same spirit.

His name is: Guy Stout, he’s a Chartered Financial Planner, working for an organisation called Doyle and Palmer. Mobile 07765 408320. Office 01329 227421.

Emma has an equally good adviser, her name is Sally Read-Cayton, who works for Foster Denovo, based in Surrey. Her contact details are 01932 870 720.

My advice is for you to run your own ‘beauty parade’ of financial advisers and after due diligence, run with the one that you like the most.

It’s important that they understand your personal needs and have good rates (the latter is important – even a small fee difference of 0.5% adds up over time). It’s also amazing how the quality differs is out there so put the effort in your search, and go with your instinct. It also should go without saying, beware of scammers, and make sure the your advisor is genuine go to FCA website to check and call them on their published number and perform all the usual checks.